We’re here to help with an IVA

Everyday life can make managing your money difficult. Debt can become daunting. We all know that ‘more month left than money’ feeling!

Our 5-star debt support service is here to help (see how we’ve already helped hundreds of other people just like you). Quick and easy debt support so you can feel better about your finances.

Talk to one of our experienced advisors today about the easiest way to manage your debt.

Whatever your situation, our help is always clear, kind and super helpful. If its just a general question you may have or if you need a hand on how to apply for an IVA (Individual Voluntary Arrangement), we will help you with that.

What Our Customers Say About Us

Great feedback is what makes us stand out

How an individual voluntary arrangement (IVA) can help you

Do you owe money? Looking for debt help? If you live in England, Wales, or Northern Ireland then talk to us about an Individual Voluntary Arrangement (IVA). It could be just the thing you need to help solve your financial problems.

What is an Individual Voluntary Arrangement (IVA)?

Exclusive to England, Wales, or Northern Ireland Our expert debt consolidation support uses an Individual Voluntary Arrangement (IVA) to turn the money you owe into a single monthly payment WITHOUT the stress of taking on new debt.

A debt consolidation arrangement between you (the debtor) and the people you owe money to (your creditors), IVAs are a popular solution that allows you to write of a percentage of debt without going bankrupt.

How does an IVA work?

You make agreed monthly payments, normally over five years. In some cases, depending on the circumstances you can make a one-off payment; this is known as a ‘lump sum’ IVA.

Once your IVA has been successfully completed any remaining unsecured debt is WRITTEN OFF.

An IVA is only available to people who live in England, Wales, or Northern Ireland. If you live in Scotland you can enter into a Protected Trust Deed (PTD), which provides a similar solution to the IVA, For more info about a PTD click here.

Talk to us today. Discover how to lift the weight of debt from your shoulders and live a debt free life.

Clear Money Solutions - debt help and debt consolidation solutions with your best interest at heart.

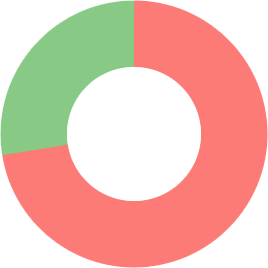

Example of the savings with an IVA

Monthly Repayments

Before IVA:£300

New IVA Payment:

New IVA Payment:£114

* Your new monthly payment is based on your circumstances and all fees are incorporated in your new monthly payment and are negotiated by the IP.

Some Benefits Associated With An IVA:

- Once the final payment has been made, any remaining unsecured debt is written off.

- Once the creditors have accepted the IVA, all interests and charges will be frozen.

- Once the IVA has been accepted, creditors cannot pursue debts. This includes, but is not limited to, the issuing of letters. Court actions associated with the debts will also cease.

Some Downsides And Risks Associated With The IVA:

- Your IVA will fail if you don’t maintain your monthly payments.

- Secured debts can’t be included into the arrangement.

- Creditors can vote against the IVA being accepted.

Types of debts that can be included in an IVA

We understand just a small change in your circumstances can have a big impact when it comes to keeping up with your monthly outgoings and dealing with your creditors. An IVA can help you and we are here to help.

Cards

Credit Cards or Store Cards. Easy to spend on, not so easy to pay off sometimes. Especially if the interest is racking up month on month. Easily build up and become unmanageable with missed payments sending charges spiralling. Sound familiar? Find out how we can help you reduce your monthly payments.

Loans

Whether unsecured loans or payday loans, it’s amazing how many people find themselves taking on new debt to repay existing debt. It’s an expensive spiral that we can help you break. Talk to us about ways of freeing yourself.

Bills

Overdue bills? We can help. Whether council tax arrears, mortgage shortfalls, utility bills or disconnected mobile phone contracts we can help you keep your household up and running.

Here is a small selection of creditors we can help you include within an IVA

Why Choose Us

Free confidential advice

Your finances are your business. Our trusted expert advisors always make it their business to always put you best interests first.

IN DEPTH ASSESSMENT

A full assessment of your circumstances makes sure we capture all the important information, so we can give you clear and effective advice.

WE PUT YOU FIRST

A well respected and highly ethical company we follow all the latest industry standards. You’re our number one priority.

THE SOLUTION THAT’S RIGHT FOR YOU

Free, confidential, no-obligation advice, always. So you can choose what’s best for you.

About us

Debt help from Clear Money Solutions. It’s what we do. It’s all we do Simple, effective and highly attentive money problem solving with your best interest at heart.

We do it very well indeed. So well that dozens and dozens of delighted and super relieved customers have given us 5 star reviews. You can read them here(input link to form).

More than 15 years of experience, FCA (Financial Conduct Authority) accreditation and a winning ‘customer first’ attitude combine to make us THE experts in solving your money problems.

Our single, simple mission? To lift the weight of debt from your shoulders so you can live a debt free life.

Less a question of whether we can help.

More a question of how?

To find out what your options are, simply fill in our quick & easy online form or call us on 0800 368 9878

FAQ's

Will my creditors still be able to contact me if I enter into an arrangement?

I have an attachment of earnings in place can this be stopped?

What are the costs and fees involved with an IVA or PTD?

How do I check if I qualify?

What kind of debts can be included?

Other Debt Solutions

What is a debt management plan (DMP)?

What is a debt relief order (DRO)?

What is bankruptcy?

What is a debt arrangement scheme (DAS)?

What is a minimal asset process (MAP)?

What is sequestration (Scottish Bankruptcy)?

Free Debt Solution Finder

Simply enter your details to see what options you may qualify for!

To find out more about managing your money and getting free advice, visit Money service, independent service set up to help people manage their money. www.moneyadviceservice.org.uk